The Cortland School District and Library Budget proposals

And other thoughts on the role of public education and public libraries

In The Center on Education Policy’s “History and Evolution of Public Education in the US,” the authors detail how democratic citizenship was an original goal in the creation of public education:

“The Founding Fathers maintained that the success of the fragile American democracy would depend on the competency of its citizens. They believed strongly that preserving democracy would require an educated population that could understand political and social issues and would participate in civic life, vote wisely, protect their rights and freedoms, and resist tyrants and demagogues.”

As residents in Cortland school district consider the 2025-2026 proposed budget and propositions, it is important to reflect on the benefits of a high-quality education not only to the individual but also to the larger society.

Highlights from the May 6 Budget Hearing

You can find the full budget presentation here.

To begin, the district highlighted their overall per pupil expenditure; Cortland spends $23,445 per student per year (2022-2023 data). Comparatively, districts within a 30 mile radius of Cortland spend more ($24,971), and the average NYS expenditure per pupil is even higher at $26,857. These figures highlight an overall cost effective use of resources in the district.

The presentation provided a thorough review of the specific administrative, program, and capital costs that comprise the budget and detailed how expenses are rising faster than revenues. Cortland is only one of a handful of districts that is being negatively impacted by the changes to the Foundation Aid formula, how districts receive state funding, which represents an approximately $600,000 loss in revenue.

The 2025-2026 proposed budget represents a 9.77% increase from last year. The main increases in costs are from:

BOCES services for special education students as well as increased payroll for special education teachers in the schools

Debt Service

Employee benefits

Utilities

While program (instruction) costs remain the largest part of the budget, the district highlighted where it decreased expenses: travel/conferences, supplies/materials, equipment, tuition for charter school students, and workers compensation costs (through participation in a workers comp consortium that reduced premiums).

To make up budget shortfalls, the district can 1) use carry over funds; 2) use reserves (district savings) and 3) increase the tax levy. And it plans to do all 3.

Tax Levy vs. Tax Rate

If you’re not a tax professional, understanding the details of the tax levy calculations can be daunting. Here is the February 2025 Tax Levy Calculation presentation from Business Administrator Kristopher Williamson for anyone who revels in numbers. I believe most people want to support schools and teachers but, amid financial pressures in their own household budgets, want to know what it will cost them.

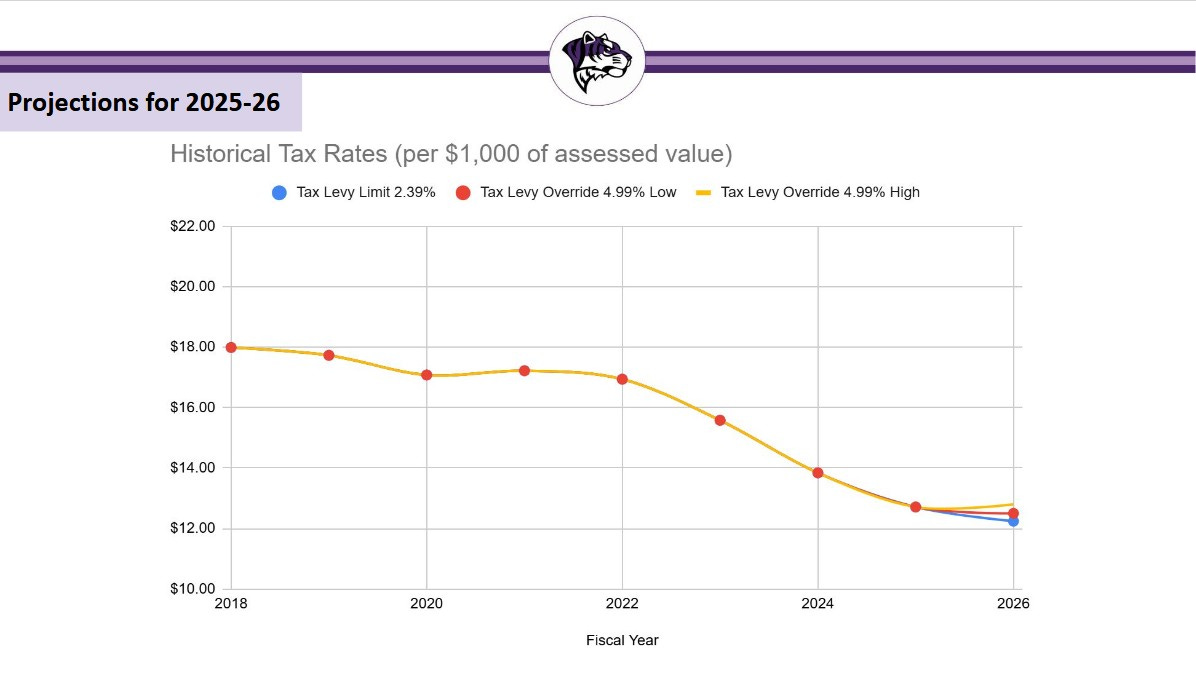

For 2025-2026, the proposed tax levy increase is 4.99%, which will require a 60% approval (not just a simple majority) to pass since it exceeds the tax cap limit. However, your final tax rate won’t be calculated until the summer when all property assessments are finalized.

The Tax Levy is the total amount of money raised from the district property tax. The Total Assessed Value is the sum of all the Real Property Assessments in a Taxing Jurisdiction. The Tax Rate equals the Levy divided by the Total Assessed Value. (source)

(Side note: A good way to bring down the tax rate is to increase the number of properties that are part of the assessment. Having more people or businesses to share the burden brings down individuals’ rates. So building new housing, addressing and revitalizing zombie properties, and attracting new businesses are important. Also important to retain the properties and businesses currently in the taxing jurisdiction. Focusing on the economic vitality of the area is a win-win. Shop local.)

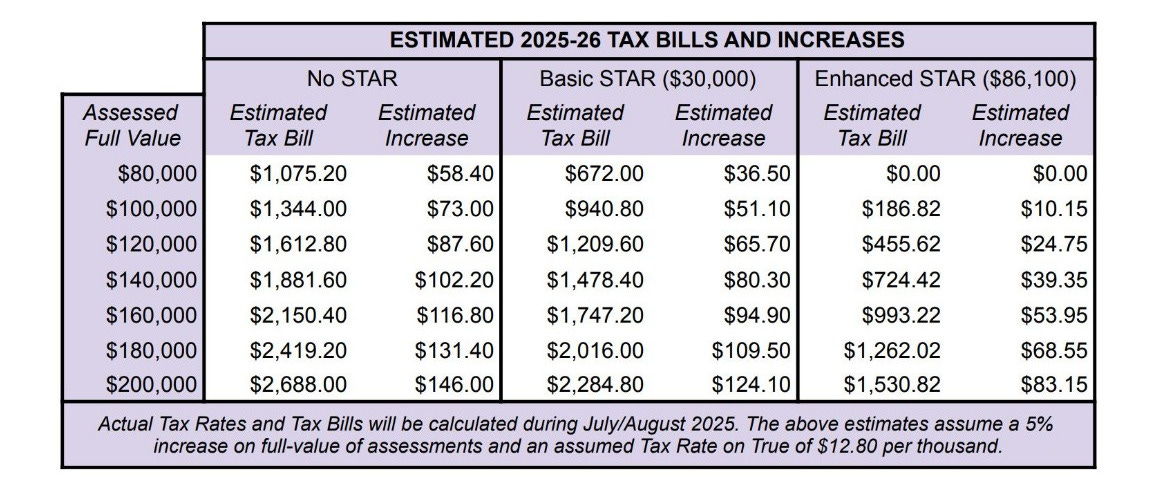

The district has provided an estimate on impact to tax bills if the budget passes (which will be proposition 1 on your ballot). If your house is assessed roughly at $160,000, your estimated tax increase will be about $100 (depending if you get a STAR exemption or not).

It is interesting to note that over the last several years, the historical tax rate (per $1,000 of assessed value) has actually decreased from $18.00 in 2018 to approximately $12.80 in 2026, if the tax levy override passes. However, your actual tax bill has likely increased since your property value increased. Your property value increasing is a great thing for your overall net worth; unfortunately, you don’t actually realize those gains until you sell your house.

Each resident in the district will be receiving a 4-page color booklet with more information about the upcoming vote and can view past presentations and documents on the district budget website.

Proposition 5 - Cortland Free Library Budget

The community will also vote on the Cortland Free Library Budget as part of the school district voting process (proposition 5 on the ballot). The library has a funding website with more information and highlights the value the library brings to the community. The library is seeking an increase from $461,024 to $473,724.

The library has taken a number of hits in our community over the last few years as the homelessness problem in Cortland quite literally was at their doorstep. The library clearly did not cause homelessness in Cortland, and the staff continues to live their mission as a public space accessible to all. Even as the Housing and Homelessness Coalition makes progress in our community, Cortland lacks year round services, and the library continues to be an important public space for all.

At the federal level, President Trump’s Executive Order on March 14 aimed to eliminate the Institute of Museum and Library Services. The American Library Association responded, highlighting that “the elimination of federal funding for public libraries will be felt in every community across the country, and particularly in rural areas.”

Community support of the library remains vital. Access to free books and materials, and free admission to programming, encourages life-long learning. Last year, the library hosted 437 programs with 8,693 attendees, mostly focused on children and youth. With over 5,600 registered borrowers, the library remains a place of learning and access.

Final Thoughts

Public education is a public good. Just as having accessible roads and clean drinking water benefit society as a whole, an educated populace benefits all. And public schools, unlike private or charter schools, have an obligation to educate ALL students. Similarly, public libraries are open to ALL.

The authors of the “History and Evolution of Public Education in the US,” conclude by stating:

“The reasons why public schools came into being—preparing people for jobs and citizenship, unifying a diverse population, and promoting equity, among others—remain relevant, even urgent. Public schools reflect our values and influence our future.”

Voters on May 20 will have a direct impact on our schools, community, and future.